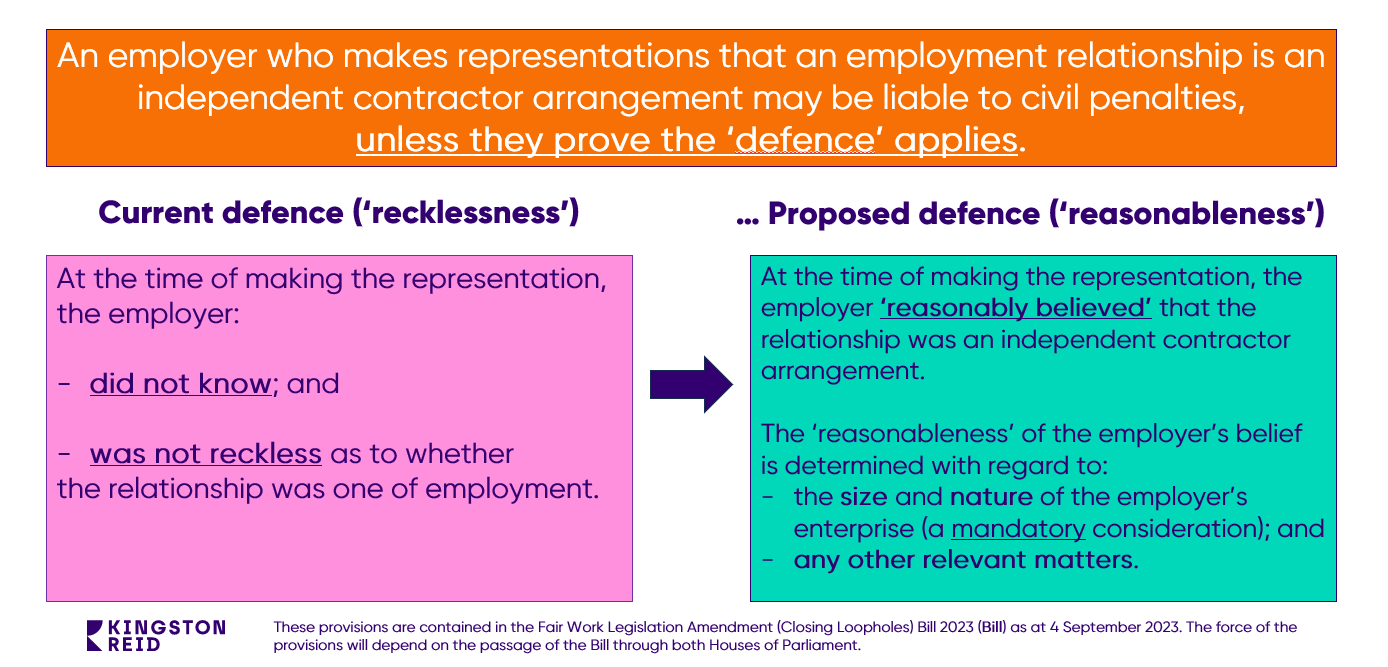

Under section 357(1) of the Fair Work Act (FW Act), an employer must not make representations that an employment relationship is an independent contracting arrangement. This is often called ‘sham contracting’. Engaging in sham contracting gives rise to civil penalties.

A defence to sham contracting is provided under section 357(2) if the employer proves (the burden of proof rests with the employer) that at the time of making the representation, the employer:

- did not know; and

- was not reckless as to whether,

there was an employment relationship.

What is proposed? A new defence

The Fair Work Legislation Amendment (Closing Loopholes) Bill 2023 (Bill), if passed, will repeal the current defence and introduce a new one.

The proposed new defence will apply if the employer proves (the burden of proof remains with the employer) that at the time of making the representation, they “reasonably believed” that there was an independent contractor arrangement.

The Bill changes the defence from a subjective defence, based on an employer’s knowledge and recklessness, to an objective defence, based on an assessment of reasonableness.

The proposed legislative changes give the Courts wide discretion to determine whether an employer’s belief was reasonable.

The size and nature of the employer’s enterprise is the only mandatory consideration (which aligns with the FW Act’s objectives to acknowledge the special circumstances of small and medium sized businesses). Otherwise, a Court may consider “any other relevant matters”, examples of which include the following:

- the employer’s skills and experience;

- the employer’s industry;

- how long the employer has been operating;

- the presence or absence of a designated human resources or industrial relations team within the employer’s enterprise; and

- whether the employer sought legal or other professional advice about the proper classification of the individual and if so, acted in accordance with that advice.

The new test will only apply to representations made on or after the commencement of the Bill.

Why the change?

The Labor Government says that the current defence is not effective at deterring sham contracting, as it was far too easy for an employer to establish (the subjective defence) that they did not know the true nature of the engagement and did not act recklessly when making representations.

The new (objective) defence will require employers who have misrepresented employment as an independent contractor relationship to prove they “reasonably believed” that the employee was an independent contractor, not merely that they did not know and were not reckless as to an employee’s correct status.

What this means and what now?

If the changes are passed, then:

- Organisations (including labour hire providers) should carefully assess their independent contractor arrangements (including current arrangements which may expire, and be subject for renewal, after the Bill passes) to ensure they have a reasonable basis to classify independent contractors as such.

- Even if an organisation makes out the new defence (i.e. they prove that their belief at the time of the representation, which may be wrong, was reasonable), the employer may still be liable for other civil penalties and/or backpay in relation to contravening the National Employment Standards, modern awards or enterprise agreements. Again, a wholistic and careful assessment of independent contractor status is critical.

- Organisations, particularly medium to large organisations, should ensure their human resources team and other staff who engage employees or independent contractors, are aware of the fundamental differences between an independent contractor and an employee, and consider implementing training if necessary.

- The new defence does not alter the High Court’s position in ZG Operations Australia v Jamsek and CFMEU v Personnel Contracting for determining independent contractor status. As such, organisations should continue to ensure that their written contracts with independent contractors are fit for purpose.

Please get in touch with us if you would like to discuss the proposed changes and what they mean for you in further detail.